Today’s Awesome Post is from Leah Manderson: Credit is such a huge component to a sound Financial Foundation. Leah’s recent experience with her credit score is such a huge eye opener. As if trying to buy a home isn’t stressful enough. We think it will be helpful for you also.

Most people know that your credit score is important because it dictates whether you’ll get credit, and how much your interest rate will be. Fewer people know that the difference between a Fair score and a Good score can total over $100,000 in interest. That’s important because…

My husband and I have been house shopping recently!

We recently found a great home at a ridiculously good price, and, being that rents are higher than a monthly mortgage in our area, we’ve decided to take the plunge into home ownership We are in great jobs that we love, we are on a good financial footing, and feel confident in our ability to maintain a home.

After having our offer accepted on the home, we went to set up an appointment with our loan officer. Knowing that our two credit scores would have a huge impact on the interest rate on the loan, I checked mine using an online tracking software. The software reported a 740, and was ready and confident going into the meeting.

We had our meeting with our loan officer, and all was going along just fine. We were chumming around, going through our many documents, and then, he got up to close the door. Uh oh time. He said, “we have one little issue.”

It turns out, the credit score I saw wasn’t quite right.

But what was wrong? I’ve always prided myself on my excellent relationship with credit. I have only two cards, I pay them off every month, and have never felt too much pressure to spend beyond my means.

I’ve also always prided myself on my credit score. When I went to buy my first car, I qualified for 0% interest for the entire duration of the loan–just because my credit score was practically perfect. Two years later, my high credit score qualified me for 0% interest on furniture store line of credit.

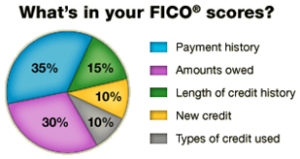

Seeing this trend over the course of 3-4 years, I always assumed that my pay-off-every-card habit was keeping my score high. After all–around 35% of your credit score comes from paying your debts on time.

What’s more, I am hyper-diligent about checking my credit reports, and am blemish free. Further, in monitoring my credit score online, I’ve consistently ranged between 730-780.

That’s good enough to qualify for some of the best rates. However, it turns out that you can’t trust the online monitoring service.

While I can’t remember the exact scores the loan officer quoted me, I know that one ratings agency put my score in the upper 600’s—clear out of eligibility for the best interest rates.

This was such a huge blow to my ego. I pay every bill on time! In full! I write a personal finance blog! I am attentive and aware and love this stuff!

After the meeting, I sat down to figure out where my credit score went wrong and how I can make it right. I knew that credit utilization was a huge part of your credit score, but seeing the “good” and “excellent” ratings on my online credit monitoring service was hiding the problem.

Your credit utilization is how much of your available credit you’re using and boils down to Balances/Limits. Say you have $10,000 of credit between two cards. If you have $2,000 of unpaid debt (no matter what the interest rate!), your utilization is 20%.

Personal finance experts agree that you should use a maximum of 30% of the credit available to you at any one time. After running the numbers, my credit utilization was at a whopping 45%.

Remember those 0% interest rate lines of credit? They were the death of my credit score.

I’ve purposely paid only the minimum on these debts. I earn more in interest by having my money in the bank and in investments than I do by paying down loans. The low payments improve my cash flow, meaning I have more money left over at the end of the month to save, invest, and spend.

My thinking has always been, “the bank doesn’t need my money, so why should I give it to them?” Well now, I’ve learned the reason!

In all, though, I’m not one to lay down and take the hit. There are a few things I plan to do to increase my score:

- Stop using the online credit software. For me, it was grossly misleading. There is no substitute for buying your credit score from a real credit bureau.

- Ignore the interest rate optimization game. According to most experts, I’m better off keeping my money in savings where I earn interest, and not pay down interest-free debt. In the long-run, my credit score matters more than my cash flow.

- Divert my monthly Roth IRA contributions to pay down my debt. Although I hate to do this, it has already jump started my motivation to knock out debt. I believe that focusing all of my effort on my debt will yield better results than spreading my attention between a lot of activities on a lot of accounts.

- Pay in cash—not cards. No need to rack up rewards points when your credit score is no good!

- Don’t finance anything else for at least a year. I know already that I’ll need some appliances before I move into this new home, but instead of taking out more store credit, I’ll pay with cash.

At the end of the ordeal, my husband and I chose to put the mortgage entirely in his name to get the best rate possible. (Luckily, we are buying a small house that doesn’t require two incomes!) I’m embarrassed by my score, and unhappy with myself for letting it get this bad, but it has been a life lesson that I’ll take with me forever.

I hope this inspires you to check your score and correct any mistakes you might be making. It is so important to your future!

Andrea is the Chief Chick of Smart Money Chicks. After filing BK twice (once because she panicked, second time because the pro messed the first time up), she realized that it all could have been avoided if she understood more about how her Finances worked and the options available. At that point, she wanted to help as many as she could never make the same mistakes again. Our Promise is that all the content you read on here is created or edited by Andrea

I’m confused – what “online tracking software” did you use to estimate the 740 credit score?

CreditKarma.com gives you the TransUnion score for free as well as explaining what is negatively impacting your score and what you can do to improve it.

And, since you got the house anyways, I’m confused as to why you would take steps 3 and 5? They’re detrimental to your long-term financial health and improving your credit score. To improve your utilization rate you actually need to open more accounts or have your limits increased while reducing the outstanding balances.